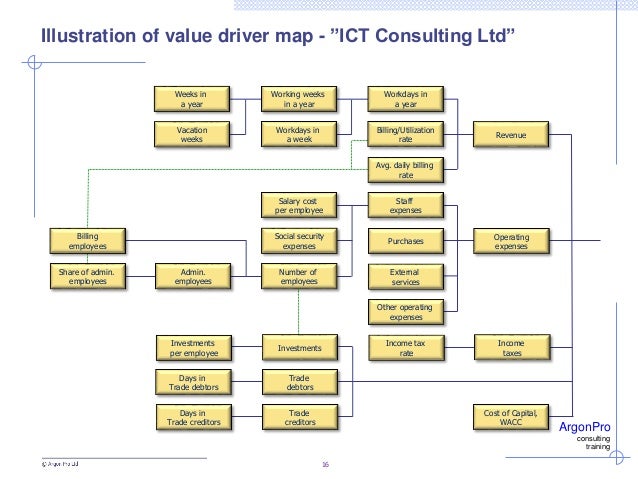

Alfred Rappaport 7 Value Drivers

With only that much experience its kind of hard to find local jobs, you really kind of have to go O.T.R. Or regional for a while with a company like Swift or Knight or Werner Enterprises. These companies take beginners with little or no experience, some requiring driving school however. I drove 48 for 1 year and 4 months and hated every day of it. I did it so I could get a local driving job after my 1 year commitment for the state grant I received. I still had a hard time finding work. Most places wanted 2 and 3 years of experience before giving me a chance.

I wound up working through a temp agency for 12 bucks an hour for months before being offered a job an a local freight del company. If I were back at my 7 week mark and knew what I knew now, I would have just gone back to community college and studied very hard at something else.

Rappaport Alfred 1998 Creating Shareholder Value A Guide for Managers and from FINANCE 102 at Mindanao State University. Rappaport, Alfred, and Michael J. Financial Ratios Business Economics Analysis of Firm’s Future Projections of Financial Statements Spreadsheets of Value Driver Data for Valuation Valuation Sensitivity. Alfred Rappaport (1998) has taken the basic concept of cash flow discounting. The required rate of return. Rappaport's value drivers.

My company makes me work long long hours and I never know when I'm coming in or getting off. I never know if I work days or nights. I hate it and I am going back to school for something else. I'm almost 40 but that won't stop me from changing my life.it sure won't stop them from trying to work me to death which is the alternative. Think about how you really want to live.good luck.

Drivers can refer to: 1. Operators of many types of motor vehicles, usually cars, trucks, and vans. Pieces of software that instruct the operating system of a computer in how to use a piece of hardware.

A printer or video card. A tool used to insert a screw. More accurately refer red to as a 'screwdriver.'

In the use of computers. Drivers are the necessary software that allow your Operating System and the device perform the function that they are needed to do.

Ex a driver is needed for sound a sound card and without the driver your computer will not have sound because the operating system can not communicate with it. Drivers are optimized for certain operating systems so make sure you get the correct version.

Shenzhencarrentals offers online car rental services in China. You can reserve your car and pick it up in the airport, in Shenzhen hotel limousine service for airport pickup and hotel transfer, Shenzhen car rental and transportation for shuttle bus and hire a car.

The first full service limousine in China. We offer top quality transportation in China: Shenzhen, Shanghai, Beijing, Hong Kong, Guangzhou, Dongguan,Zhongshan,Huizhou,Foshan,Shunde,Jiangmen,Wuhan,Xian,Beijing,Hangzhou,Wenzhou,Ningbo,Qingdao and also in Macau. We specialize in Airport service, Hotel accommodation, Travel tours and provide any car of your choice: Luxury Sedans, Minivans, stretch limos to buses. Shenzhencarrentals is available 24 hours a day, 365 days a year. We have professionally trained English speaking drivers and staff to assist you in your needs. China Office Tel: 86-071. Mobile: 86 136-3298 5580.

Website:Online bookings:bookings@shenzhencarrentals.com.

In this substantially revised and updated edition of his 1986 business classic, Creating Shareholder Value, Alfred Rappaport provides managers and investors with the practical tools needed to generate superior returns. The ultimate test of corporate strategy, the only reliable measure, is whether it creates economic value for shareholders. After a decade of downsizings frequently blamed on shareholder value decision making, this book presents a new and indepth assessment of the rationale for shareholder value. Cvetnie bukvi russkogo alfavita dlya raspechatki. Further, Rappaport presents provocative new insights on shareholder value applications to: (1) business planning, (2) performance evaluation, (3) executive compensation, (4) mergers and acquisitions, (5) interpreting stock market signals, and (6) organizational implementation. Readers will be particularly interested in Rappaport's answers to three management performance evaluation questions: (1) What is the most appropriate measure of performance? (2) What is the most appropriate target level of performance? And (3) How should rewards be linked to performance?

The recent acquisition of Duracell International by Gillette is analyzed in detail, enabling the reader to understand the critical information needed when assessing the risks and rewards of a merger from both sides of the negotiating table. The shareholder value approach presented here has been widely embraced by publicly traded as well as privately held companies worldwide. Brilliant and incisive, this is the one book that should be required reading for managers and investors who want to stay on the cutting edge of success in a highly competitive global economy. 'synopsis' may belong to another edition of this title.